2021 was a ‘Year of Renaissance’ for NFTs. From the mainstream perspective of the market, after the crypto cat project boomed in 2018, NFTs finally in 2021 ushered in a concentrated outbreak where many flourished. On the one hand, Opensea has taken the lead in NFTs trading, forming a blue-chip phalanx of NFTs led by CryptoPunk, BAYC, Coolcat and other projects. On the other hand, GameFi projects represented by Axie Infinity combines NFTs with DeFi, successfully bringing the brand-new economic model of Play to Earn to the mainstream market. In the great bull market, NFTs succeeded in overtaking the curve to attract main market funds, and it has become an important asset class in the blockchain world. Since 2022, the NFTs market has inevitably been affected by the macro market condition. After the frenzy, market participants began to rethink the fundamentals of the NFTs track: What will be the future of NFTs? What will be the next NFTs hotspot?

The current NFTs market can be classified into at least two relatively independent categories: Digital collectibles and utility NFTs. Most PFPs would fall into the former category, whose value comes from the scarcity, hence the valuation is very much subjective. Utility NFTs are quite different as the valuation is supported by their intrinsic value.

GameFi assets are an iconic example of utility NTFs. The value of GameFi assets can be clearly quantified based on the potential cash flow value derived from the P2E tokenomics. Thus, DeFi infrastructure is potentially very relevant to the utility NFTs with a similar significance as to the fungible token assets.

Shape The Markets: An Overview Of DeFi Infrastructure

So how would the DeFi infrastructure be built in the NFTs market? We can look at the DeFi world. Based on the magnitude of significance, we can easily identify the four most essential pillars that support the whole DeFi world: Uniswap, AAVE/Compound, Synthetix, and YFI. But why?

The formation of any financial market would not be possible without the maturity of the following 4 markets First, a market that sufficiently discovers the price of assets is fundamentally essential for the purpose of price provision on all levels of liquidity. Secondly, a market that sufficiently discovers the interest rate of assets that gives an answer to the question “how can we effectively price various levels of risk in this market”. Then, based on the two aforementioned markets, a series of derivative instruments can be created for investors to manage their leverage, thus adding more liquidity to the market. Finally, there comes the aggregator, which gathers the assets and liquidity scattered around the market to lower the barrier to entry of the market. And as a result, more liquidity would be injected into the market. Through the whole process, a basket of ‘mainstream assets and the ‘anchor of value’ (DAI or USDC) would also be discovered and widely adopted.

Available DeFi Infrastructure for Utility NFTs

Compared to the more established DeFi markets, infrastructure for utility NFTs. OpenSea being the primary NFTs marketplace, the trading mechanism, however, is based on order book model. The efficiency of such a matchmaking mechanism is low. It might be a viable solution for low liquidity digital collectibles with subjective valuation, but is clearly not servicing the purpose of continuous price discovery for utility NFTs very well.

Since the value of utility NFTs is derived from the inherent value of cash rewards in Play-to-Earn scheme, the mechanism designed for lending and borrowing utility assets is significantly different from the logic of token asset loans. It is more similar to a finance leasing or rental business in the real world where the ‘right to use’ can be transferred without any change of ownership. The implementation of the ‘right to use’ function in a decentralized manner for NFTs has become a big challenge.

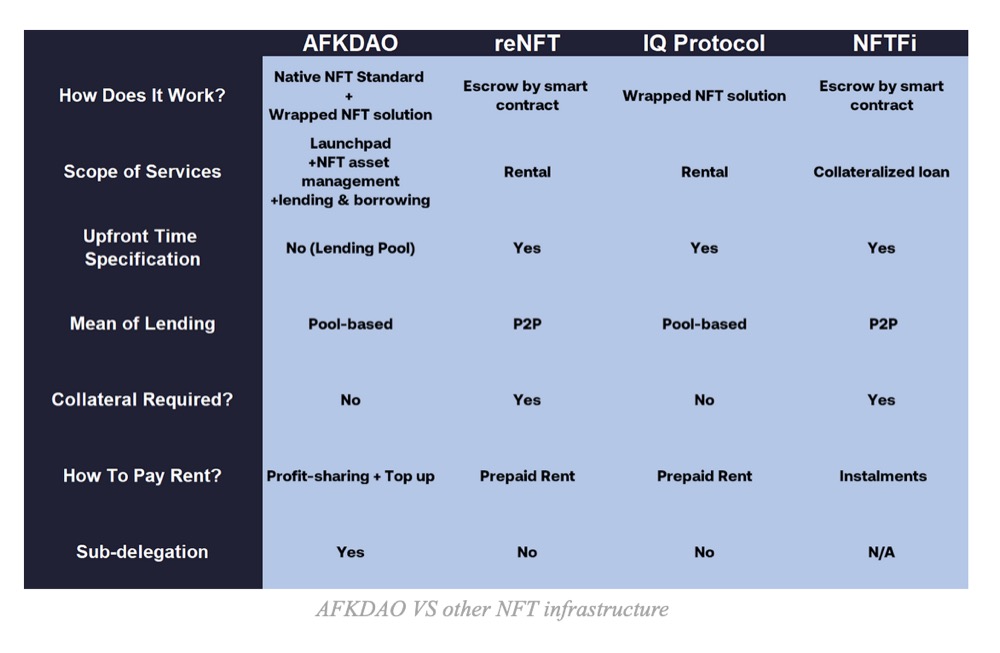

Luckily, some projects have already started offering innovative solutions to this problem. We will discuss the pros and cons of each of these projects in several aspects.

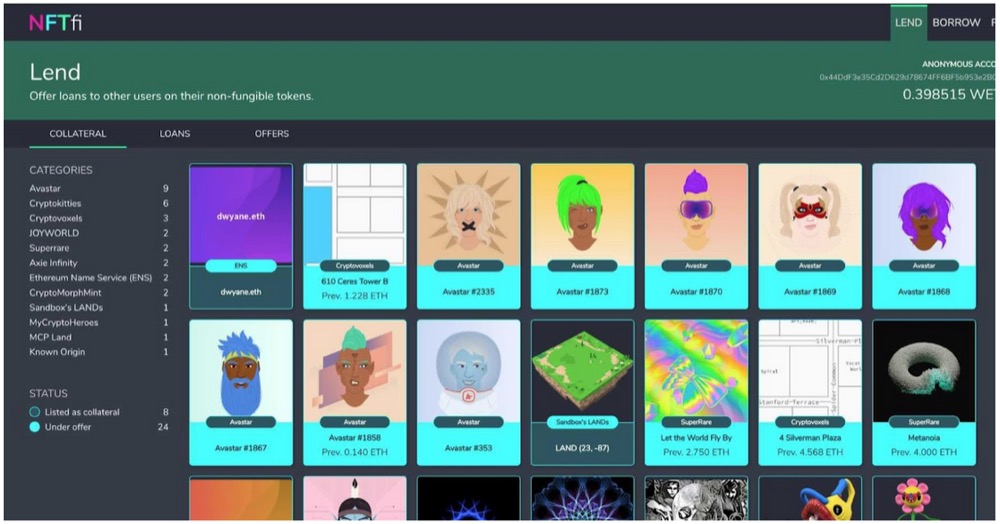

NFTFi

Launched in June 2020 by Stephen Young, NFTFi is a marketplace for NFT mortgages. It allows users to deposit NFTs as collateral to borrow crypto assets such as ETH or WDAI.

How It Works?

As an NFTs mortgage platform, NFTFi allows borrowers to deposit accepted NFT assets as collateral for issuing a loan amount from platform. The renter will set the duration schedule of the loan as well as the interest rate, and the borrower has to follow the terms of agreement. The lender is able to claim collateral assets if the borrower breaks the contract.

Strengths and Weaknesses

NFTFi provides a platform for NFT assets holders to collateralize their NFTs and obtain loans in a decentralized way. This platform is implemented by smart contracts with very simple liquidation mechanisms. For example, if collateral asset value fails to cover the borrowing amount of assets, it occurs liquidation.

The platform enables holders of NFTs to access liquidity with collateral. However, the core issue is how to determine the price of NFTs reasonably. The NFTs price market is highly volatile, and due to the poor liquidity of the NFT assets, the floor price of NFTs can drop significantly and trigger liquidation. In this case, the borrowers will suffer a loss very easily. To prevent that, the borrowers will always leave a huge buffer premium, and this significantly reduces the fund-use-efficiency.

We can draw the conclusion that NFTFi’s protocol is not a perfect solution to solve liquidity problems for utility NFTs.

reNFT

reNFT is a leasing platform which NFT assets holders can lease out their assets and receive rental revenue over the lease period of the assets. From the NFTs borrowers’ point of view, if there is a temporary need for some particular NFT assets, instead of buying they are able to rent out suitable NFT assets through this platform.

How it works?

Borrowers are required to clarify the lease schedule in advance and transfer the corresponding lease fee and collateral (the value should be equal to the NFTs assets price) into the third-party escrow smart contract. When the borrower returns the NFTs by requirements, the collateral is also returned. If the borrowers fail to return the NFTs, the collateral will be paid to the renter as compensation. The price of the collateral is obtained by Chainlink from the OpenSea platform. The collateral will also be used to generate interest on the AAVE which increases the fund-using-efficiency.

Strengths and Weaknesses

reNFT proposes a solution for NFT lending and borrowing, which brings value to idle NFTs and enables cash flow. It aggregates assets from renter and borrower through an escrow smart contract, thus allowing asset security for both.

However, the liquidation mechanisms require collateral and occupies high rate in capital to prevent liquidation. Secondly, the renter and borrower must pre-determine the lease schedule and pay upfront. The leasing method is based on peer-to-peer matching which is low efficiency.

IQ Protocol

IQ Protocol is a DeFi tool introduced by PARSIQ whose main role is to provide the framework that enables controlled rentals of assets in the form of Time-limited wrapping.

How it works?

IQ Protocol has not yet officially launched, but from the information in its white paper, IQ Protocol will try to wrap an NFT into a rentable wNFT. The asset will lock up ownership as it is lent, leaving the borrowers of the asset with only the right to use but not the right to sell or transfer. With this approach, there is no liquidation mechanism during the process as it effectively avoids the risk of losing the NFT itself.

Strengths and Weaknesses

The solution proposed by IQ Protocol is well suited to the practical needs of utility NFTs, i.e., the transfer of usage rights while ownership remains unchanged. The entire lending approach will be realized by wNFT liquidity pool, and its lending efficiency is greatly enhanced compared to the P2P approach.

However, since wNFT itself is a Time-limited NFTs derivative, IQ’s leasing solution still requires both renter and borrower to pre-determine the leasing schedule and pay the rental fee in advance when the lending occurs. Another issue with IQ Protocol is for applications that rely on recording on-chain interaction data within the NFTs, such as fully decentralized games. The Wrapping and Unwrapping processes may lead to lost or incoherent on-chain data within the NFTs.

AFKDAO

AFKDAO is a DeFi infrastructure solution for the utility NFTs, introduced by Ben Gothard’s team in late 2021 and announced its SDKs on Github in early 2022.

It was first applied to Play-to-Earn projects which helps to provide a life-cycle lending and liquidity solution for GameFi assets.

How it works?

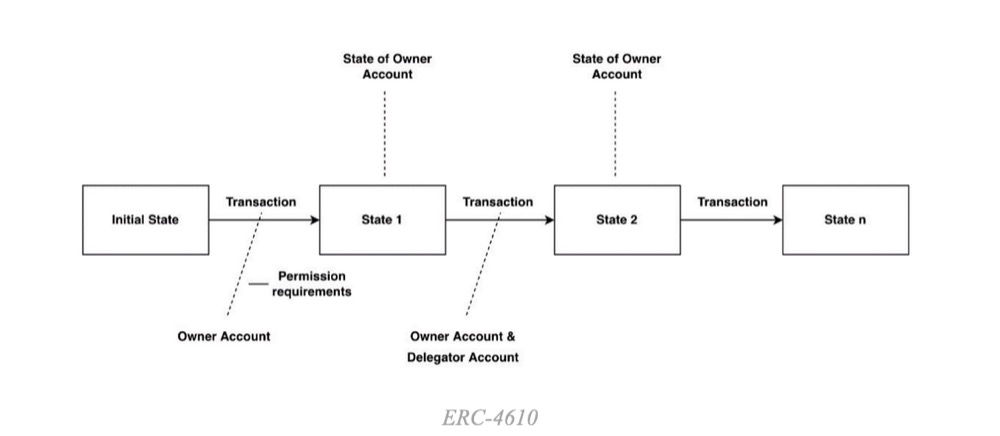

The solution is based on the new ERC-4610 protocol which is an extensible protocol for NFT assets developed by AFKDAO. Erc-4610 is designed to be fully compatible with the NFT format ERC-721. A holder of an ERC-4610 NFT can issue the right of usage to others, without relying on any third-party platforms/smart contracts.

The approaches of implementation are available for ERC-4610:

1. ERC-4610 native NFT

2. A wrapper solution for the existing ERC-721 NFTs

ERC-4610 also activates another use case of utility NFT assets: on-chain NFT asset management and profit distribution.

In the case of P2E games, the protocol allows the lending of GameFi NFT assets to others, while all the rewards are managed by smart contract, which can be divided among multiple parties in predetermined proportions.

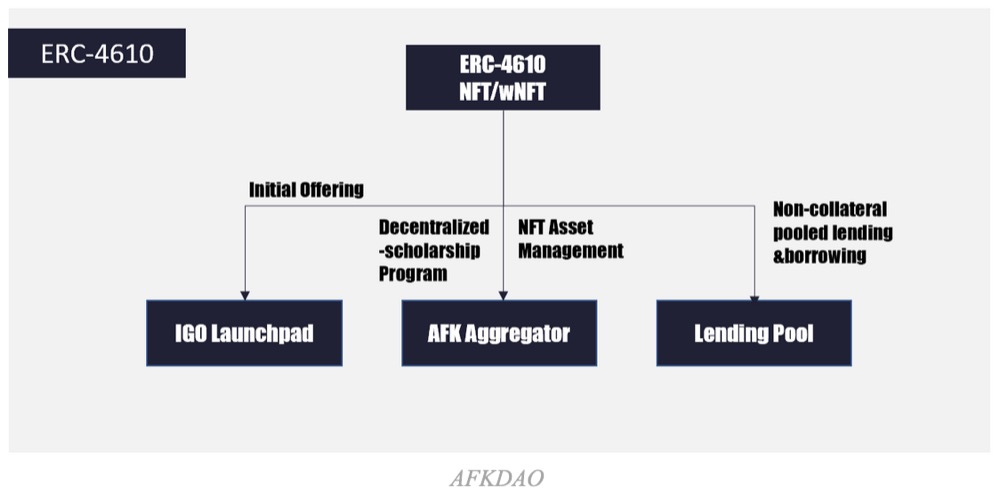

The AFKDAO comprises 3 modules: NFT Launchpad, AFK Aggregator and NFTs Lending Pool. Through these three products, AFK tries to explore a sufficient pricing mechanism for utility NFTs.

Any assets launched on the AFK Launchpad must be ERC-4610-compatible, either being ERC-4610 native NFTs or wrapped into ERC-4610. The Play-to-Earn mechanism must be open on the sale day, and a vault would be required to open in order to make ROI stats available to the community. This enables the buyers to discover a reasonable price range for NFTs before and after the sale, which helps to prevent hype-speculation which sets high barrier to entry of the projects.

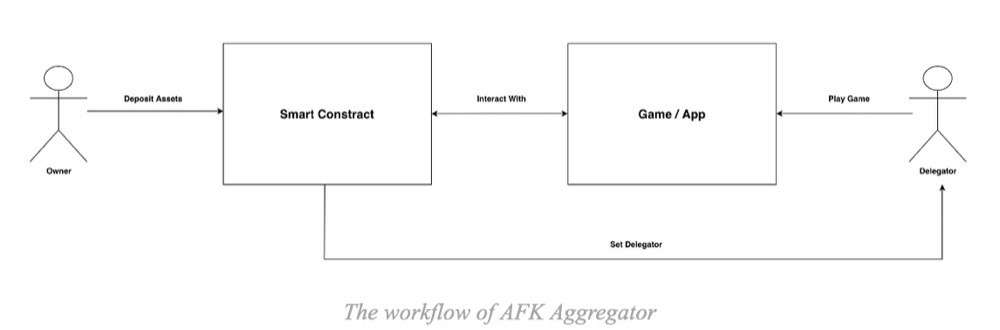

The AFK aggregator is a YFI-like fund management protocol but for NFTs. It aggregates utility NFT assets in a fully decentralized way powered by ERC-4610.

When it comes to the P2E game use cases, AFK Aggregator enables the players or guilds to raise NFT assets for the purpose of profit generating and sharing fully on-chain by setting up a ‘vault’ and defining the details of the raise. NFT owners simply need to stake to delegate the guilds to manage their NFTs. All profits will be returned to the ‘delegator smart contract’ for automatic distribution to all parties related onchain, eliminating the need for third-party escrow or private key transfer.

The whole delegation process requires zero need for collateral as well as any upfront payment for using the NFTs. The AFK Aggregator also allows the fundraiser to subdelegate scholars, which supports the guild management needs to enable the delegation of assets to multiple addresses at the same time.

The NFTs lending pool is comparable to AAVE or Compound, which is a pooled lending and borrowing liquidity solution for NFT assets. Eligible ERC-4610-compatible NFT assets can be staked into the pool at any time for revenue while borrowers are enabled to borrow NFT assets at any time without any collaterals as long as there are enough NFT assets in the pool. Borrowers would be required to stake relevant tokens as the ‘top-up’ where interest costs will be deducted from (eg. $SLP for Axie pool, $GEAR for PlaceWar Tank pool). The interest rate will be calculated in real-time by block via the algorithm based on the supply and demand situation of the pool. When the top-up by a borrower is depleted by costs incurred, the lease will be terminated.

Strengths and Weaknesses

AFKDAO provides a relatively comprehensive DeFi infrastructure solution for utility NFT assets.

It put forward a preliminary solution to the price discovery and interest rate discovery for long-tailed utility NFTs. AFKDAO adds an access control to NFTs to separate the use right from ownership, which helps to maximize the fund utilization rate and efficiency.

At this stage, the utility NFT market is still in its early stage, AFK’s solution mainly focuses on Play-to-earn games, and more time is needed for big traction. As the scale of the utility NFT market expands, it is believed that products like AFKDAO will gain much larger adoption.

Find out more about AFKDAO on its official sites:

Website: https://afkdao.io/

Telegram: https://t.me/AFKDAOANN

Discord: https://discord.gg/p878yn6yzr

Twitter: https://twitter.com/AFK_DAO