Have you noticed the crypto market’s volatility lately? It seems every week there are new opportunities to capitalize on one coin’s surge and another’s decline. However, are you being an active crypto participant and taking full advantage of these opportunities or just sitting quietly by watching your portfolio take a hit? If you think crypto trading is only for seasoned experts, you’re wrong. Crypto loans are a fantastic tool to step foot into the profitable world of crypto trading and here’s how.

Use crypto loans to buy the dip and profit later

Take a look at this Ethereum/USD (ETH) chart. On September 2nd, ETH took a colossal fall from $475 to $335 dollars. Since then, it’s rallied over 10% to 368. Now, if you are simple HODLing ETH, your portfolio took a hit and is starting to recover. While that’s nice, you are not using the full potential of your crypto. That’s where crypto loans come in.

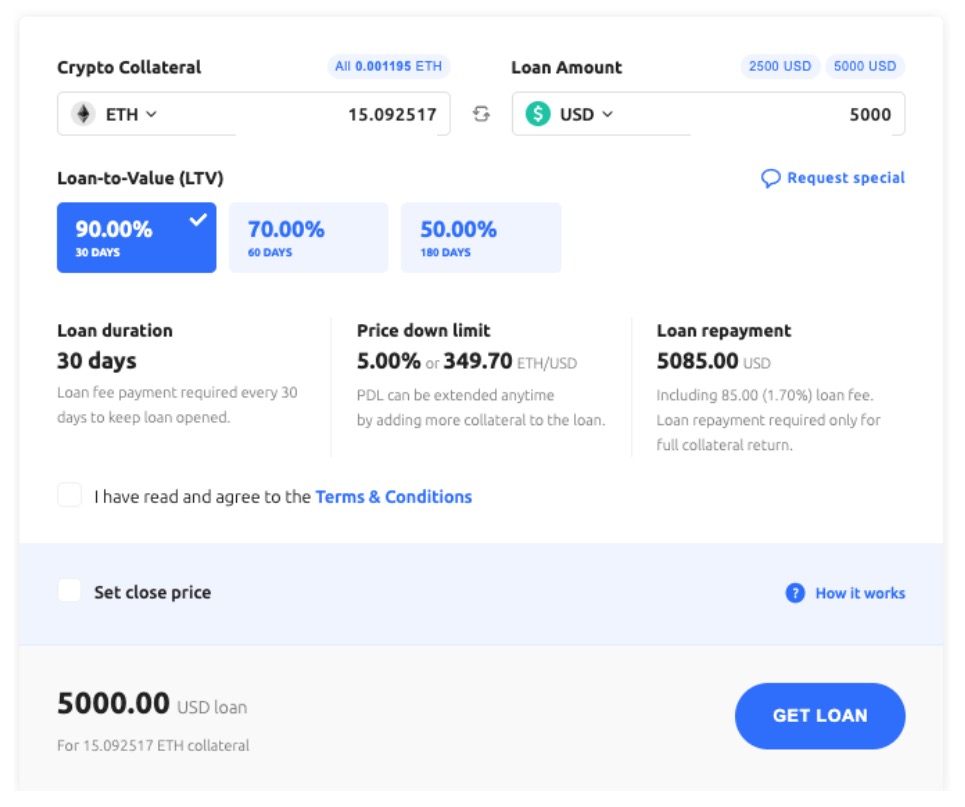

Using your ETH as collateral, you can receive an instant cash loan. Then, while the market is in the red, you use those funds to buy more ETH. Later, when the recovery starts and ETH starts increasing, you profit from that deal and also offset some of your losses from the previous dip.

There are several platforms that can help you do this but nto all are created equal. FinTech platform YouHodler has the best mix of value, innovation and efficiency to help you climb the ranks of the crypto world.

7 reasons why crypto loans on YouHodler are the best

To get an instant crypto loan with the best value and features, YouHodler is by far the top platform on the market for the following reasons.

- Industry best loan to value ratio (LTV) of 90%

- Withdraw fiat funds directly to bank account or bank card

- Top 20 coins as collateral options

- $150 million pooled crime insurance from Ledger Vault

- Receive a loan in USD, EUR, CHF, GBP, BTC and stablecoins

- Flexible loan terms and customizable loan management tools

- 24/7 customer support

Other creative ways to use crypto loans on YouHodler

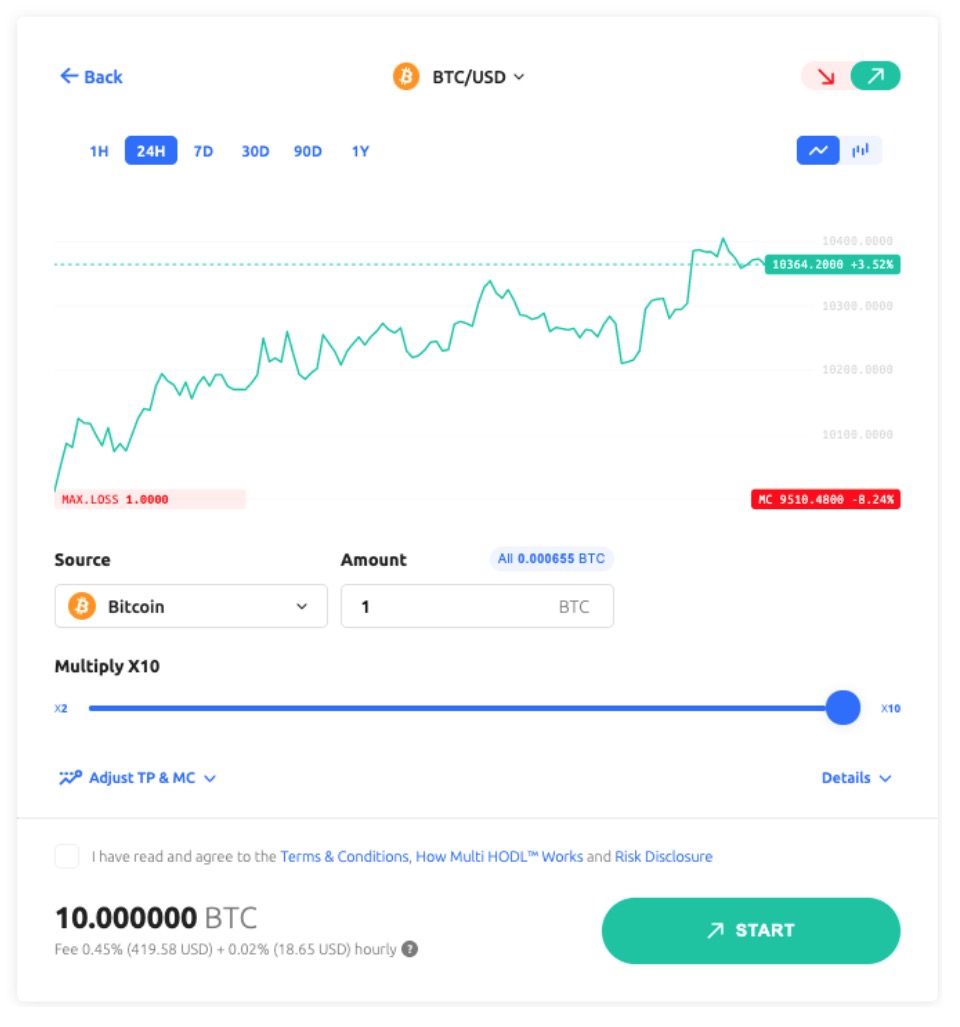

Besides their classic crypto loans, users can profit from market volatility in either direction with YouHodler’s original Multi HODL tool. Powered by their innovative crypto lending engine, Multi HODL helps users buy more crypto or sell more crypto depending on which way the market is going.

Users simply choose the source, the amount, how much they want to multiply their crypto, and the direction they think the market will go in (up or down). In addition, users can set their own Take Profit and Margin Call levels to make sure they exit the market precisely at the right time without having to watch the charts 24/7.

So next time the market takes a dip, don’t just sit there passively waiting for it to go up again. Activate your crypto and make it work for you with the power of crypto loans.

Click here to get cash now at YouHodler