PrimeXBT is a Bitcoin-based multi-asset margin trading platform that, while built on the foundations of the traditional market, is geared towards diversifying advanced trading tools, instruments and products. The platform allows its users to operate with more than 50 trading pairs, with leverages that can reach 100x in Cryptocurrencies and up to 1000x in other trading instruments, 24 hours a day.

This large number of trading instruments, as well as its high leverage, makes it stand out from many similar platforms with more time in the market such as Binance or Bitmex. It is important to note that, when choosing a trading platform like this, there are many variables that we must take into account, since not only the variety or quantity of products and instruments guarantee their quality and effectiveness.

Next, we will review this platform and discuss the advantages and disadvantages of trading with it.

PrimeXBT Overview

PrimeXBT is a margin trading and trading platform, founded in 2018 in the Seychelles Islands, which also has offices in Saint Vincent and the Grenadines and Switzerland. It enables its users to trade with leverage in Bitcoin, other cryptocurrencies, and a wide variety of traditional financial instruments ranging from currency markets to precious metals.

In addition, it offers its users other elements including its friendly interface, a simple registration process (not KYC) that only requires an email, multiple languages (including Spanish), high levels of security, very low commissions and a great liquidity.

Recently PrimeXBT was voted the best Bitcoin margin trading platform in the ADVFN International Financial Awards 2020, it was also awarded as the best cryptocurrency trading application and the best Forex and Cryptocurrency broker.

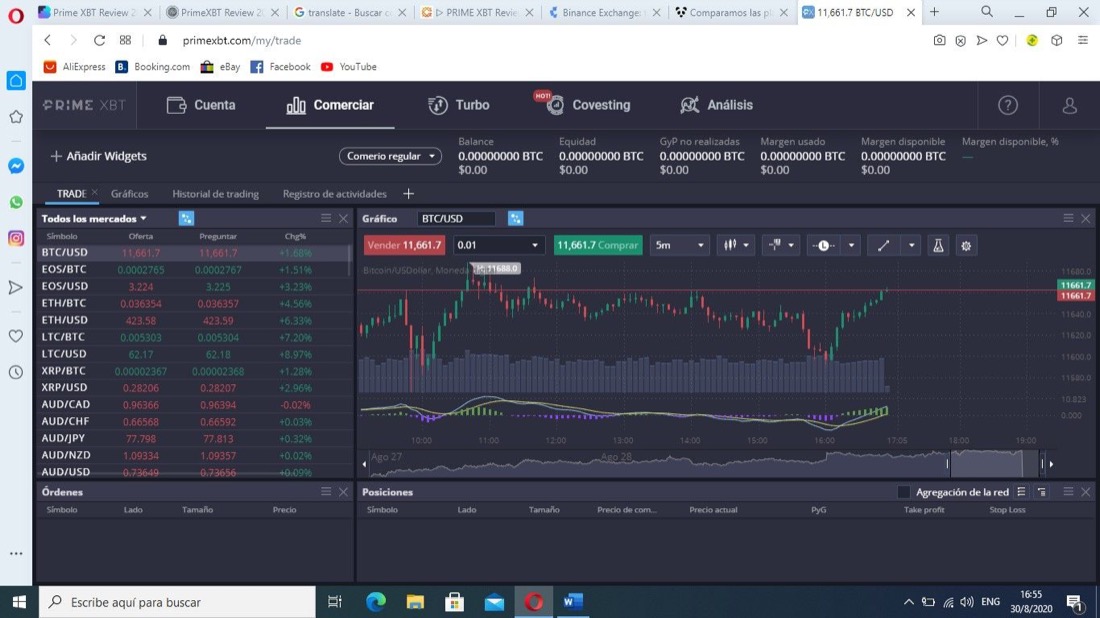

Trading tools

PrimeXBT has a set of trading tools and features that make it a high-level and competitive option, supported by elements such as high leverage, risk management tools, and much more.

The platform offers 100X leverage on Cryptocurrency trading pairs such as Bitcoin, Ethereum, Litecoin, Ripple, and EOS, as well as up to 1000X leverage for the currency markets (Forex), stock indices, and commodities.

Additionally, the platform allows you to place advanced Stop Loss, Take Profit and OCO orders, to adjust our trading strategies and at the same time manage risks without neglecting profits.

It also features charting tools such as trend lines, support, and resistance, multiple technical analysis indicators such as the Relative Strength Index, Ichimoku Cloud, MACD, and Williams Alligator, and integrated charting software.

The fact that the platform allows the opening of both long and short positions makes it possible for its users to obtain profits regardless of whether the market is high or low.

Instruments

While the central focus of the platform is Cryptocurrency trading, it also offers its users the ability to trade a varied list of traditional assets such as currencies, commodities, and stock indices.

These are the instruments and trading pairs that can be traded on PrimeXBT:

Cryptocurrencies

Bitcoin, Ethereum, Waves, Litecoin, EOS, and Ripple.

Pairs: BTC / USD, ETH / USD, ETH / BTC, LTC / USD, LTC / BTC, XRP / USD, XRP / BTC, EOS / USD, EOS / BTC

Currency markets

US Dollar, Euro, Gold, Silver, Australian Dollar, Canadian Dollar, British Pound, Japanese Yen, Turkish Lira, New Zealand Dollar, Singapore Dollar and Russian Ruble.

Pairs: AUD / CAD, AUD / CHF, AUD / JPY, AUD / NZD, AUD / USD, CAD / CHF, CAD / JPY, CHF / JPY, EUR / AUD, EUR / CAD, EUR / CHF, EUR / GBP, EUR / JPY, EUR / NZD, EUR / SGD, EUR / USD, GBP / AUD, GBP / CAD, GBP / CHF, GBP / JPY, GBP / NZD, GBP / SGD, GBP / USD, NZD / CAD, NZD / CHF, NZD / JPY, NZD / SGD, NZD / USD, USD / CAD, USD / CHF, USD / JPY, USD / RUB, USD / SGD, USD / TRY, XAG / USD, XAU / USD

Commodities

WTI Crude Oil, Brent Oil and Natural Gas.

Stock indices

Dow Jones, Germany 30, Europe 30, NASDAQ, France 40, Spain 35, S & p 500, Nikkei 225 and Australia 200.

This great diversity of instruments reflects a point in favor of PrimeXBT over its closest competitors such as ByBit or Binance, which despite managing multiple instruments do not have a variety of options to trade as diverse as this, despite the fact that in the section cryptocurrency exchange Binance has more pairs to trade.

Deposits and Withdrawals

The PrimeXBT platform is based on Bitcoin, so all deposits are made with this currency and can be from 0.001 BTC. This makes the deposit process much easier by only requiring you to send the funds to the platform’s wallet, where with two confirmations you will already credit the amount.

Likewise, the withdrawal process is quite simple due to the use of BTC and only the address of the wallet that will receive the funds must be entered. The platform allows you to make a withdrawal per day, which is processed from 12 to 01 pm GMT and its commission is 0.0005 BTC.

Any withdrawal requested before 12 pm GMT is processed that same day. Likewise, any withdrawal request made after 12pm GMT will be processed the next day.

Since PrimeXBT uses hot wallets for immediate withdrawals, withdrawals for large amounts may take some time, as they may not have the amount in them and must withdraw from their cold wallets to complete the operation.

Commissions, Fees and Limits

The platform handles only two types of commission, per operation and overnight financing. The latter is applicable to leveraged operations that are kept open at night. Thus, if a user opens and closes a position with leverage during the day, he would only have to pay the commission per operation.

The fees for operations with Cryptocurrencies are 0.05%. Those of other instruments such as stock indices, raw materials or metals are 0.01% and those of currency markets or FOREX are 0.001%. The daily financing interest rates for Long or Short position are shown in the following table.

Regarding the limit of operations, PrimeXBT establishes a restriction on the size of the positions that a user can open, depending on elements such as the liquidity of the instrument, its volatility and other market conditions. The platform will not allow users to place orders that exceed the limit if they are executed.

In margin trading, PrimeXBT will lower the leverage limits for those traders who have more exposure to the market. Leverage limits based on position size. As you can see, larger positions will require more margin and thus reduce your exposure and consequently risk.

Privacy & Security

PrimeXBT has banking-level security protocols that guarantee the security of its users’ funds. It uses Cloudflare to protect against DDoS attacks, SSL encryption that encrypts all information sent to the platform, two-factor authentication, and address whitelisting.

To store user passwords, Prime XBT claims it uses the “Bcrypt” algorithm, which prevents reading them even if a hacker had access to the exchange’s servers.

The vast majority of the platform’s funds are stored in cold wallets, which because they are offline represent an additional security measure. The hot wallets used by PrimeXBT are used for withdrawal operations and immediate payments, so the funds in them are limited.

On the other hand, in case of moving funds from a cold portfolio to a hot one, the authorization of several people will be needed, since they have a multi-signature access system.

Because the platform is non-KYC and does not require detailed personal information in its registration process, there is no risk of exposing the identity of users of the platform.

PrimeXBT Turbo

Recently PrimeXBT launched a new trading option called PrimeXBT Turbo, a Bitcoin contract that offers a binary options-like experience with greater speed and simplicity.

This product allows users to choose between upload or download contracts, with durations of 30 seconds, one minute and five minutes. While this option allows the profits of its users to multiply quickly, it also offers a high potential risk of loss.

Users can try PrimeXBT Turbo through the use of a demo account with 1 BTC, to trade without any risk and put this new product to the test.

Covesting Module

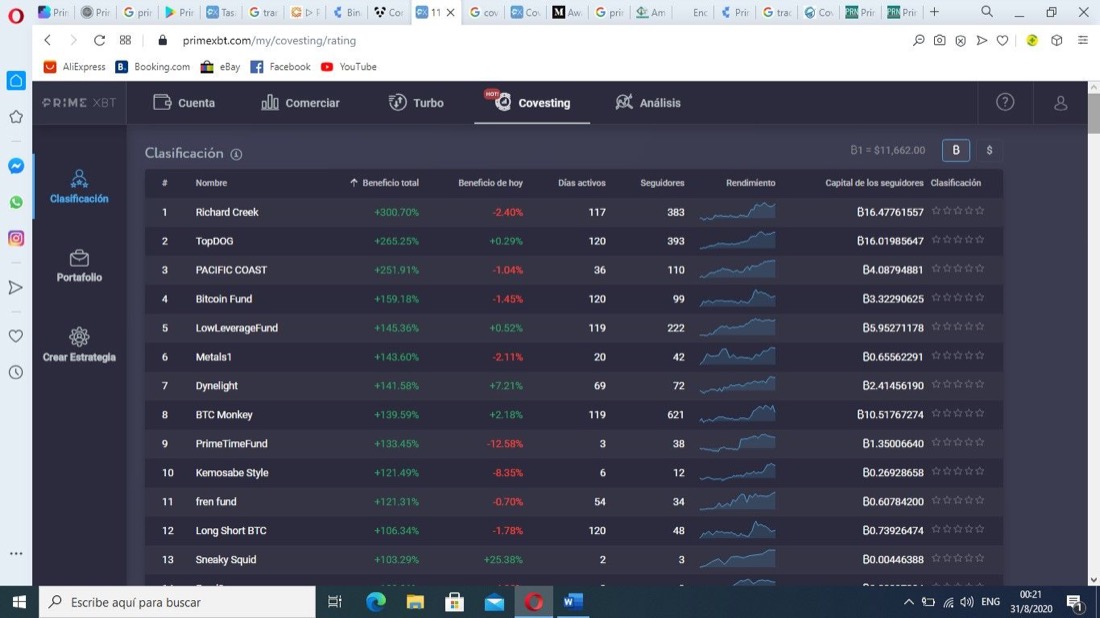

Another of the most recent PrimeXBT innovations is its new Covesting module, a product that is the result of the partnership between the financial software company Covesting and PrimeXBT that allows copy trading.

Copy trading allows inexperienced users to connect with experienced traders as followers. Then, they can copy the strategies and operations carried out by the expert traders, creating a kind of beneficial synergy for both, since the expert trader will get a percentage of the profits from his followers.

Followers will be able to trade with any experienced trader and strategy of their choice, based on the statistics supplied daily by PrimeXBT and even get a percentage of the profits generated by the creator of the strategy.

It should be noted that even an expert trader can generate losses, so it is important to be careful and attentive to the use of risk management tools when trading.

Aplicación Móvil

For users who want to review and carry out their operations from anywhere without depending on their computer, PrimeXBT developed its mobile application for Android and IOS.

This application offers functionality very similar to that offered in its traditional version of a web browser. It allows a comfortable management of the accounts and an easy execution of the operations. However, the first and most comfortable option to operate is the web version of the platform.

Support and Customer Service

PrimeXBT has a customer service and support system that is available 24 hours a day, 7 days a week. Here, users can access multiple options such as live chat, email, and help desk.

It also has an extensive library of tutorials, video tutorials and trading guides, an innovative Telegram Bot that allows its users to get up-to-date information without having to log into their accounts.

Referral program

PrimeXBT has a four-level referral system that allows its users to obtain additional income from the commissions generated by the trading of their referrals. In addition, it has created a CPA referral program where people with high influence and followers, youtubers, influencers or webmasters can obtain even greater benefits.

Interested users have an easy-to-share reference link and allusive material to promote the process.

Advantages and Disadvantages

Among the main advantages of using PrimeXBT are:

- Wide range of financial instruments. Being able to trade both crypto and traditional markets with a wide variety of instruments is definitely PrimeXBT’s main distinction.

- Anonymous accounts. The simple registration process without KYC protects the privacy of users.

- Security of funds. The platform provides strong banking-level security procedures to its users.

- 100x leverage in crypto. While leverage enhances profits, it also does so with losses, so caution in its use is highly recommended.

- Tools for trading. A robust offering of graphical and risk management tools makes trading easy for newbies and professionals.The main disadvantages of the platform are:

- Recent creation. Despite its good reputation in the market, it has only been in operation for two years.

- No client for PC. This prevents your users from operating without using the web browser.

- No API functionality. Prevents users from programming their own bots or algorithms for automated trading.

- Restrictions on use. It cannot operate in some countries such as the United States, Canada, Israel, Japan, Algeria, Ecuador, Iran, North Korea, Sudan, and Syria.

Conclusion

PrimeXBT is a solid and very complete platform that offers a wide variety of instruments to trade. It allows its users to diversify their operations, hand in hand with an easy-to-use interface, offering advanced and even professional tools.

Its high leverage and competitive rates, added to its advantages outlined above, make it an excellent option for any user, whether novice or professional, and these in turn make it stand out from its closest competitors.